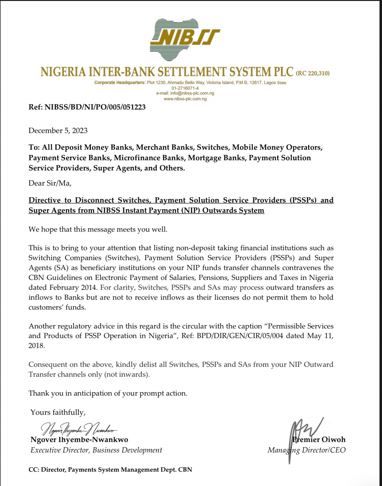

According to a circular from the Nigeria Interbank Settlement System Plc (NIBSS), banks in Nigeria have been directed to take down every non-deposit-taking financial institution from their NIP (NIP is an account-based, online real-time Electronic Funds Transfer (EFT) platform.)fund transfer channels. The NIP fund transfer channels include USSD, mobile banking apps, POS, ATMs, plus web and internet platforms.

The regulatory body warned that companies holding switching, payments processing, and superagent licenses are non-deposit-taking institutions and should not be listed as beneficiary institutions when customers attempt to make bank transfers.

The Nigeria Inter-Bank Settlement System (NIBSS) has raised concerns over unlicensed financial services companies posing as deposit-taking institutions, in a sign that the industry is looking to step up regulatory enforcement following outcry over fraud and lapses in customer verification processes by payment providers.

As fraud concerns mount in the digital financial space, this latest order would prevent a lot of fintechs from being enlisted on consumer payment apps, ensuring that fintechs with malicious intentions and without banking licenses would be taken down from banks’ fund transfer channels.

However, the circular also clarified that while these financial institutions would be stopped from receiving inflows, they can process outflows to banks as inflows.