SECTOR INSIGHT 25/06/2022

Capital Market Stakeholders Charged To Review Requirements For SMEs Access To Funding

Capital Markets stakeholders, lawyers, SME founders and business leaders, wholistically considered the challenges of the Small and Medium-Sized Enterprises (SMEs) ecosystem in Nigeria with particular focus on the challenge of SMEs in accessing finance through the Nigerian Capital Market and made recommendations for regulatory review.

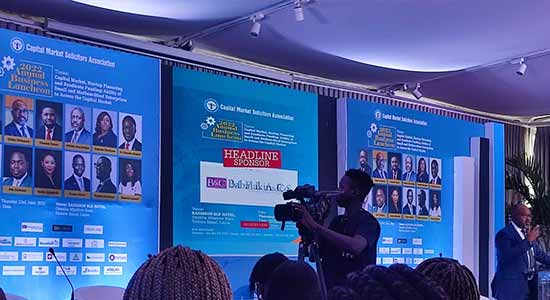

The call was made at Capital Market Solicitors Association (CMSA) 2022 Annual Business Luncheon that was held yesterday, in Lagos State.

Speaking on the theme “Capital Market, Startup Financing and Syndicate Funding: Ability of Small and Medium-Sized Enterprises to Access the Capital Market”, the Keynote speaker, Temi Poopola, amongst others, expressed optimism about the future of SME support and funding in Nigeria.

Mr. Popoola noted that whilst there are challenges faced by SMEs in accessing finance in Nigeria today a lot has been achieved by collaboration and regulatory efforts in the recent years. He noted that there has been rapid progress and innovations expressed within the SMEs financing space with increased support from government agencies for SMEs including efforts by the CBN to provide funding. He however concluded that whilst there have been several areas of improvements, much more can be done to address some of the challenges and those steps require long term solutions.

At the conclusion of the event, it became apparent from discussions and panel sessions that there is a lot more the Nigerian financial regulators in the Capital market space need to do to allow SMEs have opportunity to access finance via the capital market. It was recommended that there may be a need to review the requirements for access to finance through the capital market in order to ensure that the standards are not beyond reach for SMEs as only then can SMEs take advantage of the opportunity that the Capital markets present.

The Capital Market Solicitors’ Association, an independent self-regulatory association of solicitors and commercial law firms engaged in capital market practice, was established in 2001 primarily as a platform to articulate and promote the interest of legal practitioners specializing or dealing in capital market transactions. Through its flagship Annual Business Luncheon, CMSA brings together solicitors, regulators, capital market operators and other participants in the sector to examine topical issues affecting the capital market.

Some of the stakeholders in attendance at the event include the CEO of Nigerian Exchange Limited, Mr. Temi Popoola, who delivered the Keynote address at the luncheon, Tomiwa Aladekomo, the CEO, Big Cabal Limited, Jumoke Olaniyan, Senior Vice President, FMDQ Exchange, Toyin Sanni, Founder and CEO, Emerging Africa Group; Gbadebo Adenrele, Head, Investment Banking Division, Vetiva Capital Management Limited; Funso Akere, Chief Executive, Stanbic IBTC Capital; and Olu Oyinsan, Managing Partner, Oui Capital amongst others .