Akpabio Says Senate ‘Must Revisit’ CBN Act, Bemoans Lack Of Oversight

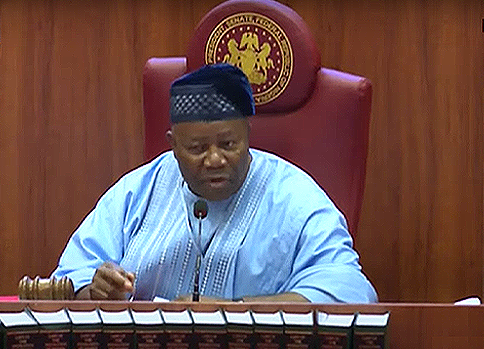

Senate President Godswill Akpabio on Tuesday highlighted the need for the National Assembly to revisit the legislation behind the Central Bank of Nigeria (CBN).

Akpabio made the assertion during ministerial screening at the Senate following nominee Adebayo Adelabu’s request for new laws instilling oversight of the apex bank amid recent “controversial” decisions that appeared to pit the apex bank against other policymakers in the Federal Government.

Adelabu, a former CBN Deputy Governor on Operations, proposed “subtle oversight” by the Economic Management Team, whom he said would interrogate several of the decisions of the central bank.

The Economic Management Team includes the Ministers of Finance; Budget and National Planning; State for Budget and National Planning; Industry, Trade and Investment; Agriculture; and Information and Culture; the CBN Governor; Special Adviser to the President on Economic Matters; and Directors-General of the Budget Office, the Debt Management Office, and the National Bureau of Statistics.

To this suggestion, Senate President Godswill Akpabio called for a review of the CBN Act.

“I think this is food for thought for distinguished senators, and that means we must revisit the act that set up the CBN because most of the problems we are seeing cannot be answered by him but he cannot stand here and condemn the very institution to which he belongs,” he said.

“But he has at least hinted (to) us that it is not every decision that he agreed with, or the other deputy governors agreed with. So, we probably would not have been where we are now if indeed we had proper oversight and monitoring of the CBN by the act itself.”

Adelabu’s disclosure comes months after a string of heavily criticised decisions by the CBN, most notably the naira redesign policy at the peak of the hotly contested 2023 general election campaigns.

One of its critics was then Minister of Finance Zainab Ahmed, who complained about the CBN’s refusal to consult her ministry before moving to redesign the N200, N500, and N1,000 banknotes and discontinue the old bills within an unprecedented three-month window.

Such decisions are believed to have contributed to the travails of policy spearhead and now-suspended CBN Governor, Godwin Emefiele, who is facing a two-count charge of illegal possession of firearms and ammunition at a Federal High Court in Lagos State.

The accounting graduate also gave an insight into the apex bank’s decision-making process, saying most of the central bank’s “controversial” policies were opposed by a minority in the five-member Committee of Governors.

According to him, minority opinions are always documented in the minutes of every meeting of the Committee of Governors (CoG), the Monetary Policy Committee (MPC), and the Board of Directors.

“Most of these controversial decisions coming out of the CBN were actually taken by either three out of five or four out of five,” he said.

“There’s always a minority opinion. So far (as) the three have the governor by their side, they have their way; the minority will have their say. They may even have superior arguments.”

The ministerial nominee explained that the CoG is made up of “five governors”, that is, the CBN governor and four deputy governors.

“We must ensure that the appointment of the four deputy governors must be independent of the central bank governor, so that they are not subservient to the governor himself,” he added.

When Adelabu was asked to address a perceived contest between the Federal Government and the apex bank, the former CBN deputy governor rebutted the notion of such a relationship.

“The CBN can never be in competition with the Federal Government because the Central Bank of Nigeria is an economic arm of the Federal Government which oversees the monetary policy functions of the Federal Government,” he argued.

The ministerial nominee added that the second arm overseeing the fiscal policy arm includes the ministries of Finance, Budget, and Planning, and the Attorney General of the Federation (AGF).

Raising concerns over the reporting line between the Central Bank and the President, he said only the governor relates directly with the Presidency.

“For five years, the President may not see any of the deputy governors,” he told the Senate.

“There should be occasions – it should be once in a quarter (or) one in six months that the entire committee of governors would meet with Mr President and then add (their views), from their own perspectives.”

In his view, once in a while, the Presidency should undertake to go through some of the dissenting opinions at the meetings of the Committee of Governors, Board of Directors, and Monetary Policy Committee.

“A number of issues may actually come out of it,” the accounting graduate noted.