Banking and Finance 27/11/2022

CBN Insists On Jan 31st, 2023 Deadline To Phase Out Current Naira Notes

The Central Bank of Nigeria(CBN) has insisted no going back on its January 31st, 2023 deadline to phase out the old N200, N500 and N1,000 notes.

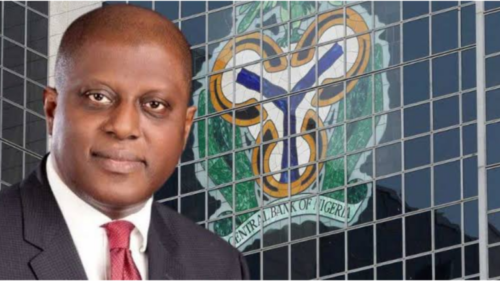

To this end, the governor of the CBN, Godwin Emefiele has urged Nigerians to go and deposit the current naira notes for the new ones not later than the deadline.

Emefiele, while speaking at the 2022 Annual Bankers Dinner hosted by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos, at the weekend, noted that, there is no going back on the January 31, 2023 deadline given for Nigerians to deposit the existing naira notes in the banks in exchange for the newly redesigned notes.

President Muhammadu Buhari had last week unveiled the new notes which are expected to be in circulation from December 15, 2022.

According to him, “please deposit your money because by 31 of January 2023 only the new notes are what is useful and you will have to dump the old ones. Nigerians will see less cash in circulation. We would like to encourage people whether it is repainting or restructuring, the most important thing is that there is a purpose for redesigning the naira. Weather you repaint or you restructure, it will end up in one colour.

“In this case, whether it is blue, or green, or it is red, but there is a purpose behind this. And I would like to appeal to Nigerians to understand the purpose or reason behind this and not about the semantics of whether we restructured or whenever repainted. But I want to warn you that if you are carrying any cash, the one that is not painted I will advise you take into your bank.

“Make sure that you return that cash to your bank and collect the new one. Even if you were depositing your old currency every day for 100 days, you will finish depositing it.”

He also promised that the monetary policy will continue to remain tight to curtail the inflationary pressures in the country.

Inflation figures had been on th rise this year rising from 15.6 per cent in January this year to 21.09 per cent as at October 2023, spurring a 500 basis points increase in Monetary Policy Rate (MPR) as the CBN fought to control money supply as a way to bring down the rate of rising inflation.

Emefiele noted that monetary policy will remain focused on the objectives of price, monetary, and exchange rate stability.

“Our policy stance will, accordingly, remain tight to curtail inflation pressure, regulate capital flows, and buoy the naira-dollar exchange rate. Monetary policy decisions will remain balanced, judicious, research driven, adequate and supportive of the real economy subject to underlying fundamentals.

“We will maintain the current tight Monetary Policy stance in the near-term, especially in view of rising inflation expectations and exchange market pressures. Though we will act to appropriately adjust the policy rate in line with unfolding conditions and outlooks.

“For the rest of 2022 and towards mid-2023 Nigeria’s rate of inflation is projected to remain elevated and above the 12.5 percent growth-aiding threshold. However, on the backdrop of our previous policy measures, and as the effect continue to permeate the system, our inhouse model-based simulations indicate that inflation rate could fall steadily to less than 15 percent by end of 2023,” he pointed out.