CRIMINAL PROSECUTION 03/11/2022

N15bn Fraud: Lawyers’ Feud Over AGF’s Representation Stalls Ex-Bank MD, Briton’s Trial

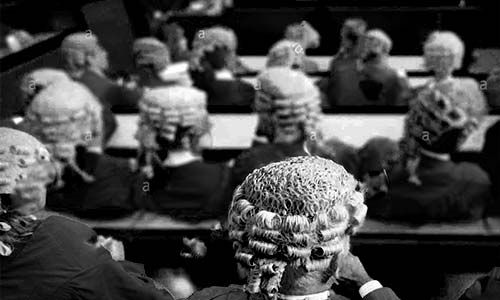

A dispute between two lawyers, who claimed to be representing the attorney-general of the federation in the trial of the former managing director of defunct Gulf Bank Plc, Johnson Adeyeba, a Briton, Gareth Wilcox and six others before the Federal High Court in Lagos yesterday stalled the matter.

The lawyers, Rotimi Jacobs (SAN) and a principal state counsel from the office of the AGF, Vivian Aibagbon, both told the trial judge, Justice Daniel Osaigor that they have been directed by the minister to prosecute the case.

While Jacobs told the court that he was in his office a few days ago when he received a ‘fiat’ issued from the AGF’s office to prosecute the matter, Aibagbon insisted that she was sent from the AGF’s office to request two weeks’ adjournments, to review the charges against the defendants, so that the office can decide on the next step to take.

After some back-and-forth arguments between the two lawyers, they failed to agree on who should prosecute the matter, as they both stuck to their position.

The development forced Jacobs to ask the court for an adjournment to enable the prosecution to put its house in order.

Consequently, Justice Osiagor adjourned the case to February 2, 2023, for the re-arraignment of all the defendants in the charge.

The former bank boss was charged before the court alongside Wilcox, the managing director of Ibom Power Company; and a lawyer, Uche Uwechia, legal advisor to the defunct Gulf Bank Plc, by the federal government on a 21-count charge of conspiracy, fraud and illegal conversion of the sum of N15, 761,176.24 billion.

Others also charged with the offences are Babajide Rogers; Ignatius Ukpaka; John Ezugwu and three Limited liability companies: Ibom Power Company; Lyk Engineering Company and Taurus Shelters Limited.

They were accused of fraud, appropriating various sums of money from the defunct Gulf bank for the use of Ibom Power Company and Lyk Engineering Limited, bridging loan facilities and taking overdraft facilities without due process among others.

In the charge, the defendants were alleged to have converted the funds from the defunct bank, in the guise of granting loans and overdraft facilities to various companies, without appropriate accounting records.

They were further accused of converting and appropriating total sums of 55.3million dollars and over N3.7billion belonging to the bank.

Part of the money was also said to have been used to finance a non-existing refinery, while the others were converted to personal use. The alleged offence is said to contravene the provisions of section 390 of the Criminal Code, Cap A6, Laws of the Federation, 2006.